|

|

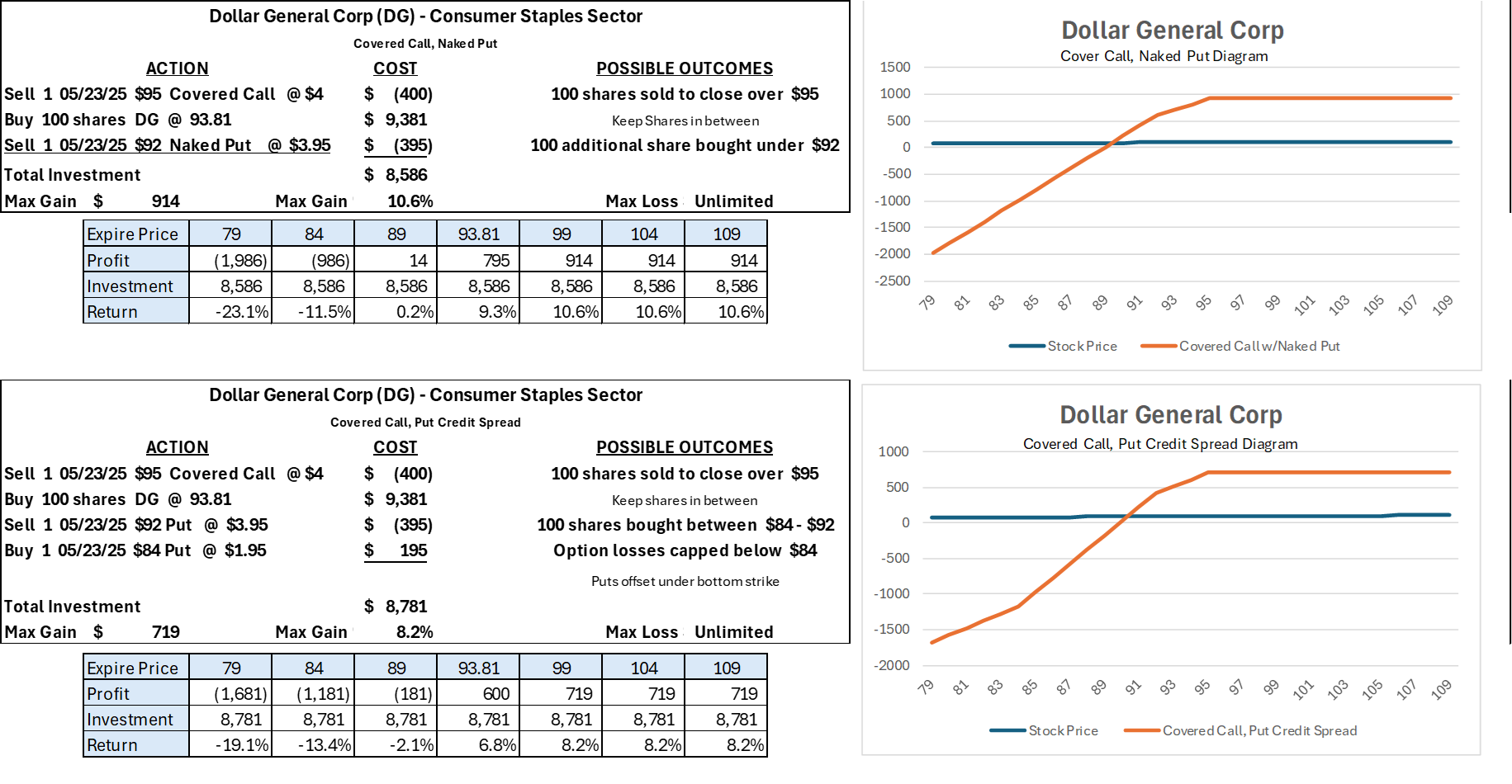

Dollar General and United Airlines top the Bull Strangle watch list this week

SpreadEdge Capital specializes in covered call writing on carefully screened stocks. Subscribe to our FREE weekly Bull Strangle Newsletter for investment opportunities. Email info@SpreadEdgeCapital.com for a copy. The newsletter covers the strategy from this article and other options for different risk profiles. Strategy Overview

Variations to the Strategy Include:

Profit Diagrams for the Various Strategies  Strategy Cycle The various option strategies covered leverages monthly and weekly options sold in 4–5-week cycles. Weekly options enables a continuous (more diversified) expiration cycle.  Market Overview  Before executing strategy trades, consider the market environment. By back-testing 31 years of S&P 500 data, a model classifies the market as green, yellow, or red. Historically, the market is green 84% of the time, indicating favorable performance and acceptable volatility, allowing 75% of strategy capital deployment. Yellow weeks show increased volatility but still favorable performance, leading to 50% capital deployment. Red periods indicate unfavorable performance and extreme volatility, suggesting minimal or selective capital deployment. Yellow and red each account for about 8% of the weeks.  Watch List Entry: Monday, April 28. Expiration: Friday, May 23. Only stocks with weekly options were considered for this cycle.  Additional Detail On Watch List Favorites     Past Performance Performance on closed trades through April 25, 2025, since inception in February 2024   More Information For a free copy of the Weekly Newsletter, please send an email to info@SpreadEdgeCapital.com Darren Carlat SpreadEdge Capital, LLC (214) 636-3133 Darren@SpreadEdgeCapital.com Disclaimer This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions. This article contains syndicated content. We have not reviewed, approved, or endorsed the content, and may receive compensation for placement of the content on this site. For more information please view the Barchart Disclosure Policy here.

|

|

|